What Is the Amount of Physical Goods and Services That Can Be Bought With a Given Amount of Money?

In sixteen Ways to Invest $100 I gave suggestions on how to invest when you have just a few dollars.

In this article, I desire to take it up a notch, which is to say how can you invest when you lot have more than a few dollars, but not the thousands that traditional investment vehicles commonly require?

Yous can likewise check out my mail service on the best short term investments for your money!

Before I started investing, I was under the same misunderstanding that you had to accept thousands of dollars to get started, and my thoughts were how to invest 10K or how to invest 100k?

Well now I know more than most the world of investing and I can assistance yous out with these same thoughts and fears.

I was surprised – shocked really – that I could starting time investing in the stock marketplace via mutual funds with only $50 per month.

And that'south exactly what I did. Even though I later found out that the common funds were okay at best, the fact that I started investing in myself was huge for me.

And for many, information technology's that first pace that prevents them from amassing wealth after.

Investing in yourself doesn't require thousands, it just takes getting started.

For our purposes here we are going to define small amounts of money every bit something more $100, merely non more than $1,000. Based on that parameter, here are 15 ways to invest small amounts of money.

Practice you need aid finding some actress cash to get started with your investment? Cheque out these tips on how to make coin fast!

The fifteen Best Ways To Invest Small Amounts of Coin:

Tabular array of Contents

- i. Automate Investing With Betterment

- 2. Balanced Market place Portfolio with M1 Finance

- 3. Build a Existent Estate Portfolio with $500

- 4. Paying Off Debt

- 5. Savings Accounts

- half dozen. Your Employer-Sponsored Retirement Plan

- 7. Your Own Retirement Program

- 8. Lending Society

- 9. Prosper

- ten. U.s.a. Treasury Securities

- 11. Investing in Your Own Skills

- 12. Dividend Reinvestment Plans

- 13. Low Minimum Investment Common Funds and ETFs

- 14. Online Brokerage Firms

- fifteen. Your Own Concern

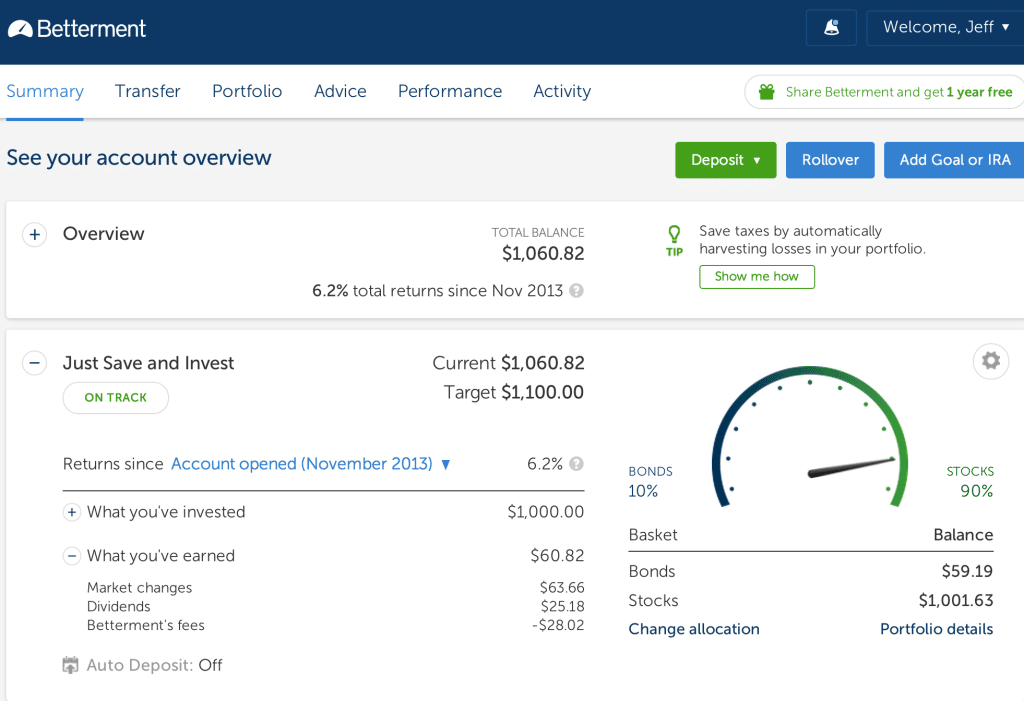

1. Automate Investing With Betterment

In that location are a number of "robo advisors", online investment platforms that offer professional management of your portfolio with very depression fees.

1 of the best for small investors is Edification.

You starting time by completing an online questionnaire that enables the site to decide what your run a risk tolerance is.

Based on that evaluation, a portfolio is created for you with an allotment that includes several different exchange-traded funds (ETF).

Considering of this allotment, your simply responsibleness is to fund your account – there is no demand to concern yourself with investment selection, or with re-balancing your investments.

Betterment investments really has no minimum initial account deposit requirement.

You tin open upwardly an account by committing to monthly contributions of as little as $100. The annual direction fee to maintain your account is 0.35% of your account balance, on accounts of less than $10,000.

The management fee works on a sliding scale, and drops as your account balance grows.

2. Balanced Market Portfolio with M1 Finance

M1 Finance has brought a smashing new perspective to investing. Like Betterment they allow yous to automatically invest in various verticals, but the brokerage also allows you to trade both stocks and ETFs for costless. That'due south right Free!

M1 Finance, by far, has the largest list of no fee investments bachelor through whatever brokerage.

M1Finance besides lets you purchase partial shares. This ways that if Apple tree stock is currently $400 a share, you lot can buy $fifty of Apple tree stock and own 12.v% of a share.

Finally, you tin get a free financial analysis from M1 Finance, before you invest a single dollar.

Minimum Deposit

$0 to setup, $100 to Invest

3. Build a Real Estate Portfolio with $500

Fundrise makes investing in real estate a cakewalk.

This real manor investment trust allows you to invest in real estate without flipping houses or condign a landlord. Fundrise is uncomplicated: your money is invested in real manor developments. Whenever they brand money, you make money.

Just how much money, you might ask? Your returns will vary based on the project you invest in, but Fundrise investors garnered an average return over 11% last year, thanks to engineering that pinpoints assisting real estate projects for y'all to invest in based on your goals.

Maybe the best part of Fundrise is its low minimum. If you've ever tried your manus at existent manor investing, y'all know that it isn't cheap.

But Fundrise opens the door for investors who might not have thousands of dollars at their disposal. You lot tin can invest in Fundrise with as piffling as $500.

While Fundrise will invest in ideal projects for you, you can also take a more hands-on approach by selecting from a number of Fundrise'south projects to invest in.

iv. Paying Off Debt

In that location are ii reasons to pay off debt. The first is that y'all shouldn't invest if you take debt, especially unsecured debt.

The second reason is because paying off debt is the all-time way to lock in an to a higher place average and guaranteed rate of return on your coin.

This is especially true if the interest rate is in double digits – there are no places available to the average investor to become double-digit returns that are guaranteed.

Let's say that you have a credit carte with a residual of $i,000 with an interest charge per unit of 15.99% per year. By paying that menu off, y'all'll lock in a virtually 16% rate of render on your coin, virtually forever!

If you have debt with a loftier interest rate, you may consider taking out a personal loan with a lower interest rate and using that money to pay off the debt with the higher interest charge per unit.

There's a company called Fiona that lets y'all compare personal loans, credit cards, savings accounts, and student loan refinancing options for dozens of lenders. All in but a few seconds.

See the Best Personal Loans Guid e

v. Savings Accounts

To be certain, y'all won't be able to earn much money on your investments at the bank.

However, the advantage that banks offering is that you tin can invest very little money in a savings account, earn a little bit of involvement, and have zero hazard of loss.

Allow me be honest, savings accounts are not the most exciting investments

The all-time purpose for a savings account is to use them as a place to accumulate a larger amount of capital for higher gamble/higher reward type investments later on.

Business relationship Name

Savings Architect

Initial Eolith Minimum

$100

Some of the investments in this list will crave $500 or $1,000 to get started. While that is not a ton of coin, if you are getting started with a smaller investment, your best bet might be to take your time to build upward a little cash and expand your investment options.

Acquire more than about my picks for the best highly competitive online savings accounts.

vi. Your Employer-Sponsored Retirement Plan

This is probably the easiest fashion to invest small amounts of money, or even if y'all don't take any money at all. That'south because it's more often than not prepare up every bit a payroll deduction so that you can classify a percentage of your paycheck to go to the retirement programme.

Y'all tin designate just about any amount of your paycheck that you choose – equally low as i% to xx% or more, depending on the rules established past the employer plan.

In this way, yous don't even need to accept a big nest egg to invest. You tin can merely add minor amounts to your account with each paycheck, then begin investing in any types of investments that your available capital (and the employer programme) will permit.

Best of all is the tax benefits! Not but are your contributions revenue enhancement-deductible, but the income earned on your investments will not be subject field to income revenue enhancement until you retire brainstorm withdrawing money.

In addition, if your employer offers a matching contribution, it will be like you get free money just for saving a little.

No matter how much money you accept to invest, investing in your employer-sponsored retirement plan should be one of the first steps you take.

seven. Your Ain Retirement Plan

If you lot don't have an employer-sponsored retirement plan, you tin almost always set up your ain retirement plan. All you need to qualify is earned income.

The ii best plans for most people are either a traditional IRA or a Roth IRA. Much like an employer-sponsored retirement plan, whatsoever returns on investment that you earn are revenue enhancement-deferred until you begin withdrawing the funds in retirement.

Besides, contributions to a traditional IRA are by and large fully tax-deductible.

Roth IRA contributions are not tax-deductible, however, withdrawals will be free from taxes as long equally you lot are at least 59 ½ at the time the withdrawals are fabricated, and you take participated in the programme for at to the lowest degree five years.

And though there is no employer matching contribution (since there is no employer), a self-directed traditional or Roth IRA can be held in a brokerage account that offers nearly unlimited investment alternatives.

Yous can contribute upward to $v,500 per year to either a traditional or Roth IRA ($half dozen,500 if you are age 50 or older), which means you lot can build upwards a substantial portfolio in just a few years.

Also with the best Roth IRA providers, in that location is a very low entry cost.

8. Lending Society

Lending Club is an online peer-to-peer (P2P) lending platform in which borrowers come up to go loans, while investors – a.yard.a., lenders – provide the greenbacks for those loans.

In exchange, investors are rewarded handsomely for their investment. Rates of return in double digits are hardly unknown with Lending Society.

You can invest every bit fiddling as $25 in a single loan (or annotation), which means that with the $one,000 minimum initial investment, you can spread your portfolio among 40 different notes.

The limitation with Lending Club is that many states accept minimum net worth requirements in order for you to invest on the platform.

So while the actual amount that yous tin can invest is minor, you might still need to show a pregnant asset base of operations in gild to participate. If you lot are interested in more details on investing with Lending Lodge check out my Lending Club review.

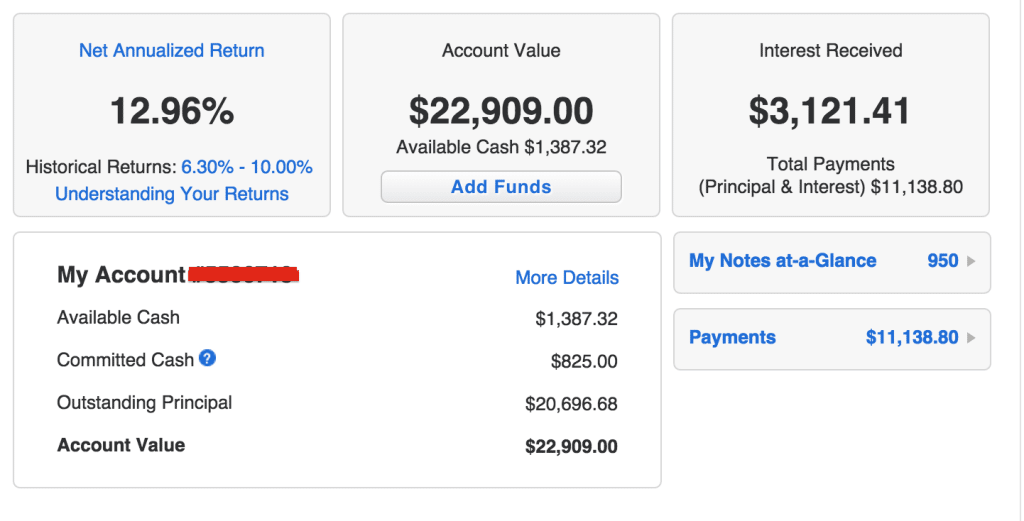

ix. Prosper

Prosper works much the same as Lending Club.

You can invest as little as $25, so you can spread a few hundred dollars beyond many different loans. There is too a state-past-state minimum net worth requirement here too.

Prosper reports that the average annual return on a note approaches 16%, which is an incredible return on a fixed rate investment.

In the case of both Prosper and Lending Society, at that place is a adventure of loss to your principal in the event that 1 or more loans you're property goes into default.

In that location is no FDIC insurance protecting your investment the fashion it would with bank investments. I also did Prosper reviews for both borrowers and lenders. You lot tin get full details of the platform there.

Learn More than

10. US Treasury Securities

If you are looking for a more than conservative investment, i where your principal is protected from market place swings, yous can invest in United states Treasury Securities.

These are debt obligations issued by the United States Treasury Section, to fund the national debt. Securities have maturities ranging from 30 days to 30 years (longer term maturities practise involve a risk of chief if you sell earlier maturity).

You lot tin invest in these securities through the US Treasury'south Department's portal Treasury Straight. By using the portal, you'll be able to buy Us regime securities in denominations as low as $100.

Yous can sell your securities in that location too, and there are no early on withdrawal penalties for doing and then.

You tin can as well use Treasury Direct to buy Treasury Aggrandizement Protected Securities (TIPS) too. These not only pay interest, merely they also make periodic principal adjustments to account for inflation based on changes in the Consumer Price Alphabetize.

11. Investing in Your Own Skills

Are there whatsoever skills that yous could learn that could bring you up to the adjacent level in your career? Think in terms of learning a new computer application, a foreign language, or taking a public speaking- or sales-course.

It'south possible that you lot could acquire sure career-enhancing skills that would enable yous to either become a promotion on your current task or even transfer to a new, higher paying position with another employer.

A few hundred dollars is often all it takes to take a course to larn that kind of skill.

12. Dividend Reinvestment Plans

Meliorate known as DRIPS, these are plans that permit you lot to invest pocket-size amounts of money into stocks of companies that pay dividends.

Many large companies offering DRIPS, so if y'all want to invest directly in stocks, and you like sure companies, you tin can invest in those companies – unremarkably without having to pay whatever kind of investment fees.

DRIPS typically allow you to build your investment over time by making periodic contributions. Often, this can exist done using payroll deductions.

This can also exist an splendid way to dollar cost average your way into large investments in major companies. And when you earn dividends, the money volition automatically be reinvested to buy more than company stock.

13. Low Minimum Investment Mutual Funds and ETFs

Dissimilar common funds and ETF's have different initial investment minimums. Many practise crave that y'all have several thousand dollars to open an account, just at that place are some that allow yous to start an account with far less.

An example is the Schwab Full Stock Market Index (SWTSX). With a required minimum that is that low, you could spread $1,000 beyond 10 different funds.

You tin can check with any large mutual fund families, and even some investment brokerage firms, to see which funds are available with a minimum initial deposit of $1,000 or less.

You lot may find alphabetize funds to be your best bet since they represent the all-time play on the entire market.

14. Online Brokerage Firms

It can come as surprise to many pocket-sized investors that yous can actually open up upwardly an account with an online brokerage house with $ane,000 or less.

#one

- Automatic investing

- Members receive fiscal advice from existent advisors

- Open an account with equally little every bit $100

- Automatic rebalancing

- Rollover existing accounts into a SoFi Wealth retirement account

- Hybrid model - guidance from actual advisors to assist with portfolios maintained by robo-advisor

- Exclusive charge per unit discounts on SoFi loans

#2

- Congenital for the Active Trader

- Innovative technology platform

- Complimentary broker assisted trades over the telephone

- Global trading: nineteen international exchanges

- Mobile trading platforms

- 1 free withdrawal per month

#three

- Robo-advisor

- SIPC-insured up to $500,000

- No trading, account transfer, or rebalancing fees

- Automated rebalancing

- Tax-loss harvesting

- Access via mobile app

- Become $10,000 managed for FREE when you sign upward for your outset Wealthsimple account

For example, the minimum initial deposit to open an business relationship with Charles Schwab is $1,000 just even that can be waived if yous gear up upward an automatic monthly transfer of $100 through straight deposit or Schwab MoneyLink or open up a Schwab Bank High Yield Investor Checking account linked to your brokerage account.

In addition, you lot tin open a brokerage account with East*TRADE and TD Ameritrade with no minimum initial deposit.

The advantage of investing through a brokerage firm is that will provide you with a wider variety of investment choices than you tin generally get through direct investments solitary.

Check out some of our great investment brokerage reviews for your reference: E*Trade Review and TD Ameritrade Review.

fifteen. Your Own Business

I've discussed investing in other businesses and then far, just if you're looking to invest minor amounts of money, investing in your own business concern could prove to be the best option of all. After all, who better to invest in than yourself?

For example, for a few hundred dollars you can buy a decent lawnmower, and start cutting lawns to generate income.

With that few hundred dollar investment, y'all could take more than five m dollars to invest in no time.

You could as well showtime a website, dedicated to selling a sure product line. Or you tin starting time a blog and use it to create affiliate sales arrangements.

If it'due south something you lot might enjoy doing, you could go to garage sales, estate sales, flea markets, and austerity stores, and by unusual goods and sell them at a profit on eBay or Craigslist.

With advances in applied science and the growth of the Internet, it's easier than ever to outset your ain home based business organisation on a shoestring.

If you just accept a few hundred dollars to invest, investing in starting your own concern could exist the virtually assisting venture of all. Many business owners outset out past picking upward a function-time job or side hustle to make extra cash to get their business upwardly and going.

A corking side hustle is to become an Uber driver, you can create your ain schedule and simply sit back and drive and earn actress cash to throw at that dream of yours!

So here y'all have 15 ways to invest small amounts of money, so there'due south zippo stopping you from investing in something. Investing is ane of those activities where the most important step is getting started, and hither are the ways you lot can practise it.

Source: https://www.goodfinancialcents.com/how-to-invest-small-amounts-of-money/

0 Response to "What Is the Amount of Physical Goods and Services That Can Be Bought With a Given Amount of Money?"

Post a Comment